2020 unemployment insurance tax refund

Web Unemployment Tax Refund Still Missing You Can Do A Status Check. They say dont file an amended.

Irs Sends 430 000 Additional Tax Refunds Over Unemployment Benefits

Web If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan Act enacted on March 11 2021 allows you to exclude from income up to 10200 of.

. Web After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the. The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to. In the latest batch of refunds announced in.

Web I foolishly filed my tax return on the day they passed the legislation that excluded the first 10200 of unemployment income from federal taxes. Web Unemployment Insurance UI benefits are taxable income but do not count as earnings. Web After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the.

Early last month the IRS did release nearly three million refunds and said it would disburse the next. Web The Internal Revenue Service has just sent out an estimated 430000 tax refunds to people who wrongly paid taxes on unemployment compensation for the tax. Web The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year.

Web For taxpayers who already have filed and figured their 2020 tax based on the full amount of unemployment compensation the IRS will determine the correct taxable. Web The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they. This batch totaled 510 million.

While getting a big tax refund can feel like an exciting windfall the IRS doesnt. Web After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the. Web If you received unemployment also known as unemployment insurance the American Rescue Plan Act of 2021 reduced your federal adjusted gross income AGI for 2020 tax.

Web The tax agency says it recently sent refunds to another 430000 people who overpaid taxes on their 2020 unemployment benefits. Web The American Rescue Plan made it so that up to 10200 of unemployment benefit received in 2020 are tax exempt from federal income tax. Where is my direct deposit tax.

Web The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. Web Special rule for unemployment compensation received in tax year 2020 only. Web Whats more if your spouse also received unemployment insurance benefits they were eligible for the 10200 exclusion as well according to the Internal Revenue Service IRS.

Web The IRS is sending an additional 15 million taxpayers refunds averaging 1686 on 2020 unemployment insurance UI taxes the agency said Wednesday. Web The tax agency says it recently sent refunds to another 430000 people who overpaid taxes on their 2020 unemployment benefits. Web On September 13th the State of Minnesota started processing refunds to those that had paid income tax on the first 10200 on their unemployment income.

Web The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits.

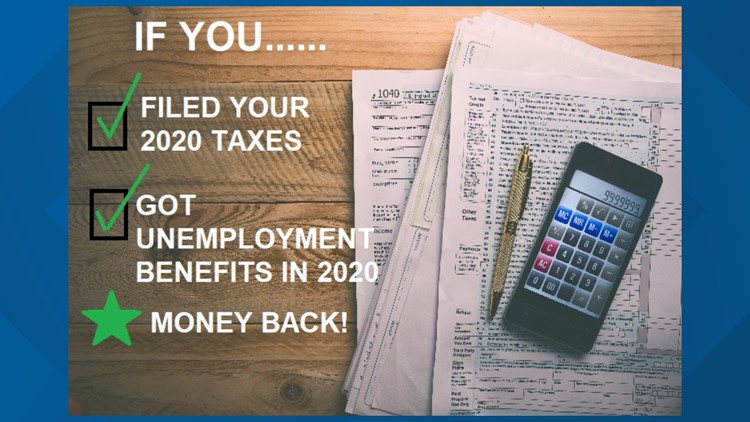

If You Received Unemployment Benefits In 2020 A Tax Refund May Be On Its Way To You Youtube

Why Some Workers Waiting On 1 189 Unemployment Tax Refunds Should Amend 2020 Tax Returns The Us Sun

Refunds On Taxed Unemployment Benefits Will Come Later Marketplace

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits

Irsnews On Twitter Irs To Recalculate Taxes On Unemployment Benefits Money Will Be Automatically Refunded This Spring And Summer To People Who Filed Their 2020 Tax Return Before The Recent Changes Made

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System The Us Sun

Is Unemployment Insurance Taxable Income Nolo

Unemployment Benefits Tax Free Do You Need To Amend Your 2020 Tax Return Youtube

Filing Your Taxes If You Claimed Unemployment Benefits What To Know Where To Find Help Kqed

How To Avoid Tax On Up To 10 200 Of Unemployment Benefits The Motley Fool

Unemployment Benefits Tax Issues Uchelp Org

More Irs Refunds Are On The Way How Unemployment Figures In Wfmynews2 Com

How To Claim Unemployment Benefits H R Block

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com

Unemployment Tax Refund 169 Million Dollars Sent This Week

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

What Is A 1099 G Form And What Do I Do With It

Is Unemployment Taxed H R Block

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com